|

Last time I bought a new phone, I noticed I could either pay at once or split payments over two years at 0% interest. For clarity, the 0% interest option meant the sticker price of the phone would be divided by 24. No interest, no hidden payments.

The second option was better mathematically. Taking a 0% interest plan meant I could keep my lump sum and do something else with it. If I stuck it in the safest investment at ~ 1% per annum, I would still end up a few pounds better after two years compared to if I paid it all upfront.

But there was no way I was taking that option. In fact, I would rather buy a cheaper phone with cash than a nicer phone on a 0% payment plan. Why? Because I know myself. I knew the angst of watching the money drip out over 24 months would outweigh the few pounds I would gain or the utility of having a nicer phone.

If someone came to me with this scenario, I would tell them what the math described and then tell them I wouldn’t follow the math. There are things I would take the 0% interest period for – just not a phone. I think the point is to manage your money in a way that helps you sleep at night, including when that means not following the math.

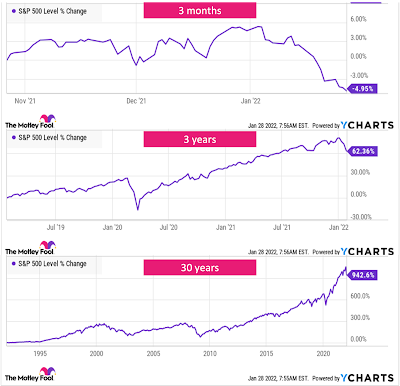

Stock markets have been turbulent, and the S&P 500 has been dancing around a correction. The top five US-listed shares held by customers of interactive investor (ii) are down year-to-date: Apple -6.42%, Jackson Financial -11.70%, Tesla -29.46%, Amazon -15.51%, and Microsoft -7.91%. Of course, this isn’t a big deal if you zoom out far enough.

|

And I think that brings us to the crux of the matter. You have to setup your investments in a way that increases the chances that you will stick around for the long term and not interrupt compounding unnecessarily. You have to set them up in a way that helps you sleep at night, even through a market correction.

For me, that means mostly buying broad-based indexes and not doing a lot of stock picking. Knowing myself, I can sleep better at night through a correction and continue buying into the dip when I’m mostly sat on broad-based indexes vs when I’m holding lots of individual stocks. There are most definitely people who can’t sleep well at night if they’re not devoting all their efforts to earning the highest returns possible through active stock picking. There’s nothing wrong with that – for them. Everyone just needs to know themselves and act accordingly.

Morgan Housel writes in The Psychology of Money:

“Some people won’t sleep well unless they’re earning the highest returns; others will only get a good rest if they’re conservatively invested. To each their own. But the foundation of, “does this help me sleep at night?” is the best universal guidepost for all financial decisions.”

*****

What I’m currently reading: Due to an enduring childhood fascination with Arthurian England, I re-read the Down the Long Wind series every few years. I just finished Hawk of May, the first book in the trilogy, for what is probably the twelfth time. Hawk of May is a beautifully told coming of age story that also includes a Light vs Darkness element and I don’t think I’ll ever tire of reading this book.

What I’m currently listening to: It’s interesting that China is still pursuing a zero COVID strategy. It reminds me of a child who is hungry but insists on not eating because she must save face after declaring publicly that she will not eat her mother’s cooking. Has China fallen into a Covid-zero trap? from the Today in Focus podcast explores this in greater detail. Except China expects to keep this up for a few decades, I expect they will have to give up their zero Covid strategy eventually.

*****

It’s a really beautiful day outside today. Wherever you are, I hope you’re having a good Sunday evening. Have a nice new week ❤️

Thank for sharing, this is very helpful.

ReplyDelete